Opinion

Certainty Blog

Team best interests or client best interests?

What kryptonite was to Superman, disrespect is to advice relationships. A few months ago one of my clients engaged a significant advice client. Prior to engaging, I worked with them to assist in the engagement and pricing. The prospect represented the type of advice...

Advising the goal-less?

Some clients appear to be goal-less. Their response to questions from advisers about their goals or future returns a form of “I’m fine thanks very much for asking” or "I'm quite happy where I am at present". Advisers are often too stumped by such responses and timidly...

Clients kicking ‘own goals’ using Adviser’s tools

Own goals in football are nightmares for footballers. Own goals in financial services however are rarely noticed. An own goal in football occurs due misjudgement, misfortune or freak incident when a player accidentally kicks the ball into their own net creating a goal...

Goal-setting or Goal-washing? What advisers can learn from the space program…

“The future does not exist and cannot be predicted. It must be imagined and invented” Gelatt (1989) On May 25, 1961 USA President John F. Kennedy delivered an ambitious speech seeking Congress support to a project that would be ‘...more impressive to mankind, or more...

When feeling strangled by compliance, trust your original business model

The eleventh sitting of the mandatory FASEA exams started this week. An adviser preparing for her exam suggested that once most advisers had sat these exams, she hoped the regulator might reduce their onerous compliance burdens. Hope isn’t a great business strategy....

The Greed Factors

What do the behaviours of Melissa Caddick, Bernie Madoff, and Sam Henderson have in common? Greed. Justice Kenneth Hayne used the same word when tabling the final report of his Royal Commission into the Banking and Financial Services industries in February 2019....

Advice is more about the complexities in our lives than the goals

Marketers love a good slogan. Goals-based financial advice is a good example. Advisory firms sometimes differentiate themselves on their goals-based advice capability to understand and identify their advice client's aspirations. Some institutional advisory groups...

Advice: What are the Consequences?

"Nothing is worth doing unless the consequences may be serious." ~ George Bernard Shaw Financial advice is less about financial products and more about consequences, particularly significant consequences. Obviously, not all decisions have significant consequences....

The Financial Relationships in our Lives

Financial Relationships are the third of four essential balancing acts of a comprehensive financial adviser. Joe was clear what retirement looked like. So was his partner Silvia. The pressing issue to resolve was the universe of differences between their hopes. He...

Time to make an impact

The impact of the 2020 coronavirus is immeasurable. What is measurable however is the impact of New Zealand’s Jacinda Ardern’s leadership overseeing her country’s response to the virus. Significantly too is the comparative measure of her country’s response compared to...

Beware Charging based upon Hourly Rates

Imagine a hole-buyer and a hole-digger met at the local hotel to discuss a much-sought-after hole. After a few drinks, the job is agreed with the digger starting as soon as possible. Next day the digger is on-site unloading the digging gear out the back of the digging...

FASEA – Destination or Stepping Stone?

Read the latest October 2020 Guidelines for FASEA? I initially expected these guidelines might provide the "rail lines" for advisory firms to align their growth. Thanks to an extraordinary 2020, advisory firms are seeking as much probability and clarity as possible to...

Compliance or Priorities?

I love Monty Python humour. Remember the crucifixion or freedom skit from "Life of Brian"? Michael Palin playing the whimsical centurion questioning a line-up of captives regarding their fate or freedom. Many financial advisers seem to have become captives. Captives...

The value is in the details – theirs, not yours.

I love flying. Always have. Long flights, short trips, big planes, tiny ones, hang-gliders, choppers. When I was a kid, Dad would sometimes drive out to a small park on the Cooks River which bordered Mascot airport to watch the arrivals and departures. From there you...

Stop calling product recommendations advice

Would you regard a product recommendation from a Toyota dealer or Apple store as ‘advice’? Do you think bias makes a recommendation less valuable? Do you think it matters? Consider the ‘advice’ members of Australia’s second largest Superannuation Fund – QSuper – will...

Congratulations….

Congratulations to the recently announced Top 100 Financial Advisers for 2020. After exhaustive research and analysis by The Australian and Barrons, this list of talent represent the best in Australia. They deserve their accolades as do all high achievers and leaders...

What Advisers Can Learn from Artists?

My son is addicted to art. Big time. Turn your back on him and he's sketching something, leaving trails of charcoal fingerprints in unlikely places, getting lost in his own space. Even since he was five, his art has been his bliss (and frustration). Is his work of...

The different advice firms during Covid-19…

Covid-19 means different things to different advisory firms. I believe this pandemic has identified at least four different types of firms. So far, at least. First, there are the "plodders". Plodders These are 'steady' firms. They didn't qualify for JobKeeper as...

New Advice Narratives Needed

What's appealing about Elon Musk? His car company defies market logic with valuations of 4x revenue while companies far more established and experienced clamour for valuations at fractions of their revenue (see Prof Galloway). His space exploits are creating global...

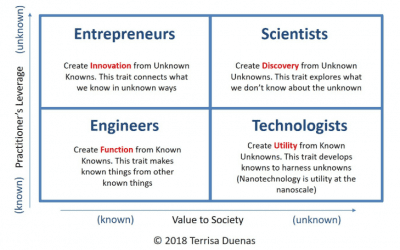

The Known Unknowns after COVID19

Unlike zoos, most financial advisers believe they will emerge from this Covid-19 experience stronger. The imposed lessons of offering flexible workplaces, the insights of client meetings via video links, the no commuting for clients and team members, while still...

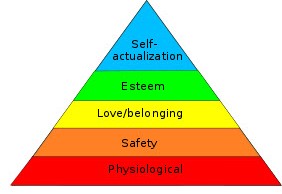

Hierarchy of Uncertainties…

“The reason most people do not recognise an opportunity when they meet it is that it usually goes around wearing overalls and looking like hard work” HENRY DODD Covid19. It won’t miss anyone. It is causing uncertainty for many. Anxiety or frustration for...

Like Never Before…

Health care is being re-defined. Massive innovation, collaboration, education, distribution, awareness, exhaustion. And bravery. Bravery continuing to serve the best health interests of patients, co-workers, community, and own family members while risking their own...

Back to Basics

What Warren Buffet is for investors, Abraham Maslow is for financial advisers. But it’s easy to forget that in these weird times. I certainly didn’t grasp the power of his theory of motivations forty years ago packed up the back of a crowded Carslaw lecture theatre....

Toilet Roll Icon

The toilet roll is an appropriate icon for the coronavirus. Like our confidence, we take our toilet rolls for granted. Until there are none left – all grabbed by fear. The same fear that steals our confidence. Add in the terrible elements of our social media habits,...

Adviser’s Balance Sheets

“There’s so much opportunity for financial advisers in today’s market”. Samantha Albiez is Senior Adviser with Bravium, a self-licensed boutique advisory firm in downtown Braddon, Canberra. The firm specialises in SME owners, young families, busy professionals and...

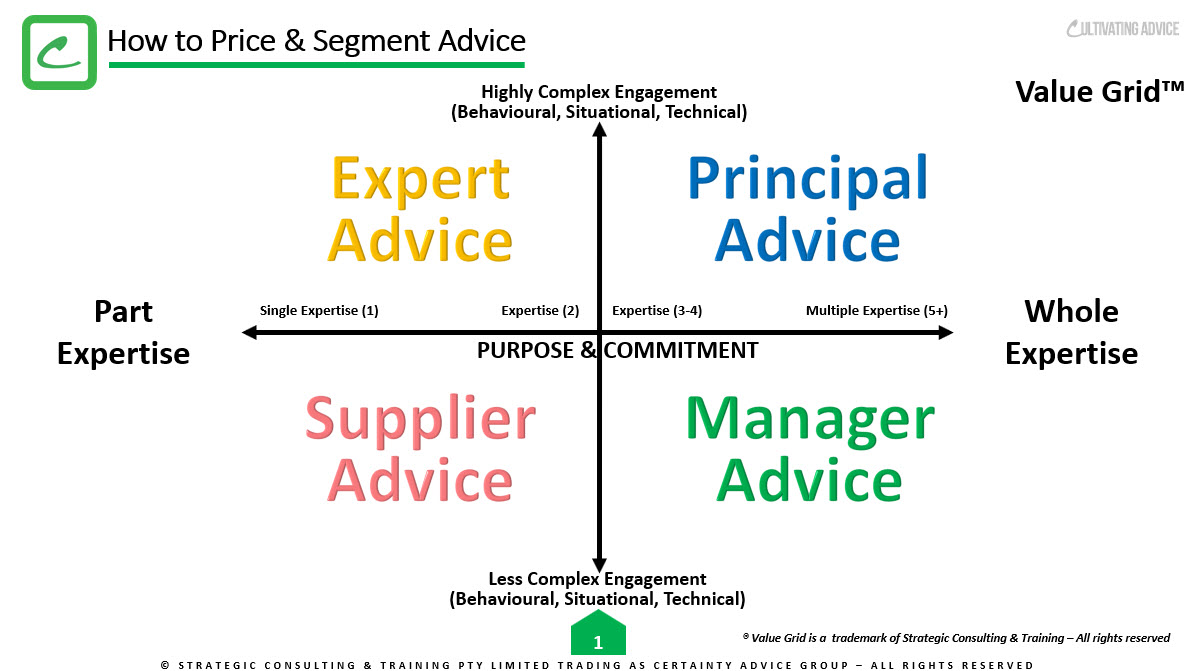

What Advice is That?

People don’t want more choices – they want to be more confident in the choices they make. Read NYU’s Professor Galloway’s musings? Easy read, makes sense, consistently clarifies some things for me. I’m presenting a model of advice in this blog. It’s for clients and...

Fair & Reasonable Price?

When’s the last time you paid a fair & reasonable price for something? This morning’s coffee? When you last filled your car? Your last holiday? Your special person’s Christmas present? Your donation to a bushfire cause? We make fair & reasonable decisions all...

2020: The next phase

Welcome 2020. A new decade for some. Regardless – every new year presents a possible milestone or waypoint for fresh starts. Waypoints are not just for new year’s or decades. They can be stabbed into our lives – such as our devastating bushfire season. Other...

A Disastrous 2020?

The 11th March 2011 Fukushima nuclear disaster caused by the Tohoku earthquake was the worst nuclear accident since Chernobyl in 1986. However, while no deaths are due radiation exposure from the disaster itself, new research suggests that more people suffered and...

The Advice Yips…

Read Good Walk Spoiled? I reckon it’s a great book. It’s about golf, but really a story about characters. Characters under pressure. That’s golf – either a casual hit or a classic test of character. At the highest levels of the game, the classic tests can be...

Valuable Connections – The Future of Advice

When we focus on ourselves, our world contracts as our problems and preoccupations loom large. But when we focus on others, our world expands. Our own problems drift to the periphery of the mind and so seem smaller, and we increase our capacity for connection. Daniel...

Financial Advice: A loss leader for lost leaders?

“Life moves on, and so should we.” Have you read Who Moved My Cheese by Spencer Johnson? It’s one of those annoyingly good books that easy to read, makes lots of good sense, yet hard to implement. It reminded me of the state of financial advice in Australia....

Can Financial Planning Firms Survive?

When do you know you are going out of business – just before you do. Why? Framing Bias. Amos Tversky and Daniel Kahneman explained this years ago. Basically, when options are framed positively, most of us have a natural bias to favour that option. Whereas when options...

Car Parking, Superannuation and Advice Fees

Our #2 Daughter, the family’s leading actress, recently flew off to find work hopefully in Netflix’s expanding presence in Vancouver, BC. Going for a couple of years, or longer based upon future stardom, the family wanted to hang around until her final few steps with...

How about we regulate the price of financial advice?

Paying for financial advice is like paying for electricity. Really? Yes, according to Alan Kohler, Editor-In-Chief at InvestSmart.com.au. Alan knows a thing or two about investing. His web page offers lots of investment options with a who’s who of experienced people...

Setting Better Standards

President Trump resets standards tweet by tweet. Telling four Democratic congresswomen to ‘go back’ to where they came sets new expectations of how the world’s most powerful office deals with a contrary opinion. Last week, new standards of governance were recommended...

The Big Short II, III, IV etc…

“At the end of the day, average people are going to be the ones; they are going to have to pay for all of this. Because they always, always do” ~ Mark Baum, played by Steve Carell in THE BIG SHORT. We still don’t get it. Did you see or read The Big Short? Great...

The Advisers Netflix Moment

My eldest daughter loved her first job. It was in our local video store during her last years at high school. Way back, she was always the one we had to drag out of the place by the collar of her Wiggles dressing gown every family video night. Her joy working there...

What to learn about our financial lives from the pre-election polls

Another election, another upset, another realisation. The realisation is that the pre-election polls distracted everyone from what quiet Australians were thinking. They were out of touch and a significant distraction. So be careful when you hear the first promises the...

Over-priced plans

I love flying. Always getting distracted by overhead planes, I’m regularly tuning into flight radar to check out stuff. Obtained my fixed and rotary wing license thirty years ago and would have the world aeronautical charts up on my walls if the family let me. The...

Value before Price

Is now the time to join the crowd shifting to industry funds? It depends on the value being sought. Value means different things to different people. Whether buying your morning coffee or another pigeon to your flock, we all value things differently. In many ways, the...

What I learned about financial advice from Kodak

Remember how we used to buy memories? We’d buy some film for our camera. While we don’t buy film anymore, we still value memories. In fact, we value and share memories more than ever – about 300 million photos uploaded every day. That growth wasn’t anticipated,...

What’s conflicted advice?

The Chinese-based Huawei Group seems to be conflicted. Despite being recognised as a world-leader in forth-coming 5G telecom technology, western countries are reticent to trust them to advise, build, and maintain their future data highways. Similarly, Robert Muller’s...

Hello, I’m from ASIC and I’d like you to justify the advice fees you charge?

Hello, I’m from ASIC and I’d like you to justify the advice fees you charge? Are you ready for this question? Reminds me of the gag about the tourist in Ireland who asks a local for directions to Dublin. The Irishman replies: “Well sir, if I were you, I wouldn’t start...

Hayne – Set – Re-Match

“When you're up to your armpits in alligators, it's difficult to remember that the original objective was to drain the swamp.” The Hayne report was an anti-climax. When our Treasurer announced the report with “From today, the banking sector must change, and...

What Price Advice?

My family is full of creative types. All the kids and wife are active artists, except me. Actresses, writers, drawers, and designers. All super talented - of course. But I was a tad surprised when some of their drawings and works were recently bought for use on a...

A hope too high for FASEA?

Have you heard of FASEA? It’s the relatively new Financial Standards and Ethics Authority, established in April 2017, well before last year’s Banking Royal Commission, to set the education, training and ethical standards of licensed financial planners. It’s creating...

How To Find The Right Financial Adviser

How do you identify the right financial adviser? It’s hard. Moreover, it is potentially getting harder. Last week the government’s chief economic adviser – the Productivity Commission - recommended the formation of an expert panel to select the ten best superannuation...

How To Determine The Value Of Advice Post Royal Commission

Have you read Robert Cialdini’s book Influence? Great book. I re-read it over Christmas. It reminded me of the influential ‘short-cuts’ in our lives. Those psychologically engrained triggers we each develop that either warn, encourage, hinder or help us quickly make...

What my garbos can teach the banks…

I’ve always left a case of beer out for our garbos each Christmas. However, this year they were not able to accept it. It’s ‘not part of council’s new code of conduct’. Really? I value the job done by our garbos in the early hours every Tuesday morning. Value was...

Genuine People caught in disingenuous places?

Maybe there is a beast…maybe it’s only us.” ~ Lord of the Flies – William Golding What happens when genuine people are caught in a disingenuous place? What did the people working on Manus Island caring for Australia’s unwanted refugees best do about their...

What’s really at stake post Justice Hayne’s Royal Commission?

What’s really at stake post Justice Hayne’s Royal Commission? It’s bigger than the gob-smacking headlines such as CBA telling it’s board one thing and ASIC another, even the new Chair of CBA considering the Hayne royal commission a threat to stability, or the poor...

Valuable conclusions from our Royal Commission?

I didn’t hear much about value in the Banking Royal Commission reporting. Pity. Specifically, I didn’t hear much about the value Australians have been seeking in their financial lives from their bankers and advisers. Counsel assisting Mr Hodge QC came close to it when...

What type of professional advice you after? Best Interest or Best Product?

Presume, like me, you looking to buy a new car. I prefer Toyotas. Why? They do the job I need. They are reliable. They are everywhere. My twenty-something kids will be safe in them,...

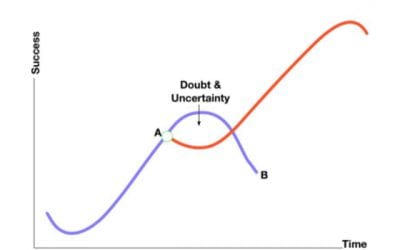

How Advice Firms Grow – Wobble Theory

How do Advice Firms Grow? In many ways. But I believe there are distinct patterns that if understood as part of a bigger cycle, it may help you grow faster or appreciate how you are growing (or why you are not growing as you'd hoped). I've developed a growth model...

How to identify good Advice Conversations…

How do you know you're having good financial advice conversations? What are the things to listen out for, to query, or to notice to confirm you having good advice conversations to ensure you're on track for your best possible financial future? It's not...

The new financial advice models – it has to be about value

For many inevitable reasons, traditional financial advice models are changing. To date, there have been two main aspects underpinning the delivery of personal financial advice. These two aspects have been the amount of money an individual has, and the financial...

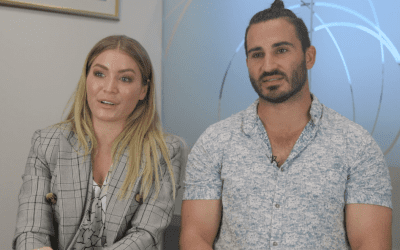

No strings attached financial advice – it’s the future of advice.

Katie and Tim are clients of Reine Clemow and his right-hand-lady Donna Loverick at Acquira Wealth Partners in bustling Southport. You know what struck me listening to them? Katie and Tim were very informed, aware and particularly certain of one thing. They didn't...

Future Australian Advice – predictions as the banks exit…

Another bank is exiting wealth. Saying his objectives are all about simplification, NAB CEO Andrew Thorburn used unsurprisingly similar language to ANZ's CEO Shane Elliott nearly two years prior when he too concluded that they really did not understand advice enough...

Advisers fighting to retain their ‘grandfathering’? What?

What's with financial advisers fighting for their 'grandfathering'? Should you care? Quite possibly. Because it could be your money the advisers are fighting to hang onto. Firstly, what does grandfathering mean? Wikipedia suggests that 'grandfathering' "is a provision...

AMP? The future…

The future of AMP? I reckon they’ve only one option. But first, a reminder of those days pre the 2000 Sydney Olympic Games. I first heard the term ‘puzzle-palace’ in the reception of AMP Alfred Street’s Sydney foyer – it was just pre-Games. The helpful guy manning...

What’s wrong with Financial Services? – It’s not culture, it’s systemic…

Beware too much focus on culture in the Justice Hayne's Royal Commission into the banks, superannuation and financial services industries. Blaming culture for past behaviours in the financial services industry is like blaming the seasons for our changing weather...

What I’m learning from the cute ads from the banks?

Have you noticed? Maybe I'm watching too much TV? (c'mon the Commonwealth Games are on!) But I can't help notice how many cute ads the big banks are pushing at us. (BTW - if interested, check out this great piece from We Are Social - explains nicely the five main...

The stone rejected by the builders, turns out to be a cornerstone?

Penny works within a busy accounting and financial planning firm in Brisbane. Raised and spent most of her adult life in the small country town near Toowoomba, she knows all about close-knit Australian communities and how important they can be for each other. She's...

Seeking Financial Advice? Understand yourself first…

Plato wrote a few centuries ago that the 'cure of a part should not be attempted without treatment of the whole'. A glimpse at most adverts for financial advice seems to contradict his philosophy. Most adverts suggest self-managed super funds, or low-fee investment...

Valuable Client Meetings – The Secrets of the Value Approach

What are the secrets to consistent and successful delivery of your most important client meetings? Firstly, rapport-building is over-rated. Whilst I agree that rapport provides a vital oil between all successful relationships, I reckon too many advisers use rapport...

Don’t take that advice – because it ain’t advice…

I hope Commissioner Hayne's recommendations are going to help us all understand that the vast majority of today's financial advice is not financial advice. Initial messages from his Royal Commission suggests he is focussed on how we've ended up with a banking and...

Why the adviser’s voice recorder is the surgeon’s scalpel

Interested in fast-tracking your team's understanding of client value by at least 50% in just a month? I'm serious. I appreciate your business training and development is already a priority, but is it focused on the 'heart' of your advice skills? If you are not...

What the Hayne Banking Royal Commission can Learn from Good Schools…

Kids go back to school this week. For us, after 24 years of secondary schools, we're down to the last two - time flies. Our youngest seems OK going back, particularly to catch up with mates. There are also particular teachers and coaches whose classes and teams he’s...

ANOTHER CRACK IN LONG-STANDING ADVICE WALLS?

Did you see this piece just before Christmas? Fin Services minister Kelly O'Dwyer putting forward legislation no less to empower ASIC with product intervention powers and the ability to now ban aspects of long-standing remuneration practices where there's a direct...

The confusing financial advice marketplace…

Have you tried to understand the financial advice market? If so, you’ll know it’s confusing. For instance, the ANZ bank announced last week it is selling its financial advice division for $975m to another financial services firm called IOOF. Eight years ago, the ANZ...

WHY AREN’T ADVISERS PLANNING

Does this amaze you, or what? Rob Bertino highlighted the issue earlier this week in the Fin Review (it’s behind a firewall, but you’ll get the drift). His findings are that only 12% of financial advisers are commiting succession plans to paper. Does that make sense...

Why should valuable advice be paid for up-front?

“Too many people today are paying for financial advice like they pay for a meal at a restaurant,” says Terry Powell a Principal of PF Private Wealth and a Certainty Adviser based in Geelong, Victoria. “You only pay at the end of the meal, regardless of the...

Good advice? Just wait a while…

For Jeff Thurecht and Mia Taylor, Certainty Advisers with Evalesco in Sydney’s CBD, it takes a little time for people to recognise what genuinely valuable advice is. That’s OK for them. They understand quality advice relationships aren’t created overnight. An...

ETHICAL V INDEPENDENT FINANCIAL ADVICE

Are you noticing more and more discussion about being an ‘independent’ adviser? Specifically the section 923a of Corporation Law definition of independent. Hats off to those advisers committed to the s923a road – it certainly is one far less travelled. The pursuit of...

WHEN FINANCIAL INSTITUTIONS OFFER ADVICE…

World-class financial institutions? AMP is currently revamping its financial advice business. As part of its long-term growth plans, CEO Craig Mellor stated that he intends to make his company more customer-oriented. AMP recently established an alliance with United...

The ‘cultural cringe’ of financial advice meetings

While money is the most pressing problem to all our clients, it’s surprising how few Australians are engaged in the financial advice industry. How can the same industry devoted to helping people make sound decisions around money turn everyone off so much? I believe...

Get a compliance degree – or get out?

Treasurer Scott Morrison’s recent Recommendation 25 seeks to advance the need for advisers to have a relevant tertiary degree. While advancing yourself through study is never a bad thing, I want to ask if compliance degrees are absolutely the best way to advance the...

No prizes for second place when it’s all about the revenue split

Tell me if this ‘mutually beneficial relationship’ sounds familiar: You have a new relationship with an accounting firm with great prospects. With five partners, a good name, and a similar culture to yours, there’s no reason why you shouldn’t provide wealth advice to...

Too much, too soon? When success becomes a curse

There’s good success and bad success but all success comes with strings attached. For financial advisers, the biggest challenge with success is increased activity. Not only does success draw in new clients but existing client work typically also increases. The result...

Is Robo-advice advice?

If you can learn how to drive a car, you can learn to manage your own money. That claim was recently made by the chief executive of a new fintech startup – BigFuture Pty Limited. The cloud-based wealth management service is on a mission to “democratise wealth...

Is this a new generation of advice appearing?

I reckon financial advice industry is entering a new phase of professionalism and opportunity, only everyone doesn’t seem that excited about it. As with any change there are many advice licensees and practices that refuse to embrace anything new and evolve. No matter...

How to Start Great Advice Conversations

Great financial advice isn’t about the money – it’s about something much more meaningful. Great advice is about taking clients to places they haven’t been. Great advice is about helping clients manage their un-manageable things. Unfortunately though, when it comes to...

In Your First Five Minutes (PartV) – Don’t ask, just start recording

Accuracy is critically important when documenting and showing clients the progress they’re making towards removing complexity and increasing certainty in their financial lives. Professional advice can save clients a lot of money in a short period of time through tax...

What do you do for me? – Those First Crucial Five Minutes…partIV

What’s your role? What do you do? How do you best describe your role when positioning what you do with clients, potential new prospects, or alliance partners? I’m especially interested to understand what you say in those first vital minutes of a meeting when you are...

Is there something burning? – Part 3 of those First Crucial Five Minutes

There’s something about a burning smell that’s hard to ignore. Instinctively, that smell distracts us until we can locate the cause or origin. Which is why it’s SO important to address anything that might be ‘burning’ in the financial lives of our clients as soon as...

Those Crucial First Five Minutes – Don’t Assume…

In Part 1 of this series about the first five minutes of client meetings, I discussed the importance of “setting the context of the meeting” to effectively take control of important client engagement and progress meetings. The focus of Part 2 and second crucial...

Engaging Advice Clients – The First Five Minutes – Part 1

What do you reckon? Are those first five minutes of the advice conversation between adviser and client crucial? Or is that the time for good old-fashioned rapport building? In the past ‘advisers’ (or ‘product distributors’ or ‘salespeople’) focused those first five...

What does success look like?

When people hear the ‘certainty proposition‘ for the first time, no matter how much they might like the sound of it, they understandably ask how will they be able to determine the value or success of this approach? Prior the delivery of a ‘certainty’ proposition, the...

What I learnt about financial advice, FoFA, and best interests from toll roads…

On Wednesday night a couple of weeks ago the latest round in the Future of Financial Advice (FoFA) saga limped through parliament heading for who knows where. Due successful lobbying by financial institutions, plus noise from incumbent industry associations and funds,...

Focusing on high net worth clients? Really?

Is your advice firm striving to crack the ‘High Net Worth’ market – i.e. rich people? It’s not getting a bit ‘old-fashioned’ for advice firms is it? I suppose if you use other people’s money to make your money, the high net worth client is a logical focus. Similar to...

Trying to explain best interest (and governance)…

Spoke to a financial advisory firm last week who were very excited about their very own investment platform which they now intend to offer to their advice clients. The ownership of the platform is a couple of the original owners of the financial planning firm....

Advice is not a product – Part III

Homes aren’t products. Most Australians wouldn’t pay strangers to squat in the rooms of their homes. Why do Australians accept the fees from the many faceless manufacturers, platform providers, planners, fund managers who crawl all over their superannuation? Because...

Advice isn’t a product – Part 2

Advice isn’t a product. Advice is far richer, deeper and more valuable. At the heart of good financial advice is a on-going conversation that ignites life’s possibilities and helps realise their attainment. Despite the banks alluring advertising, the value in the...

Advice isn’t a product.

Do Woolworths sell advice? Do Coles sell advice? Do banks sell advice? None of these groups sell advice. They all sell products. Unfortunately when it comes to financial advice, Australia’s consumers don’t know the difference between financial advice and financial...

Do your clients deserve the best you can deliver?

Do your clients deserve the best you can offer? Remember your first clients? Remember how hard you worked to really excel and hopefully earn their trust and future work? Back then you knew shoddy or late work would not provide the opportunities to get off the...

Why Do Advice Clients Buy – Part 2

Do clients buy for the returns you offer or the certainty you provide? Time for a re-think? Is it time for a re-think as to why advice clients will buy from you? Consider the following: the Grattan Institute recently suggested that Australians are paying way too much...

Why Do Advice Clients Buy? – Part 1

Why do your advice clients engage? For greater returns or greater certainty? I was reminded of this question looking at Google’s headlines last week with their ‘driver-less’ car? Did you see them? Google are making big promises about “changing our world” – what do you...

What I learnt about financial advice from a milk ad…

You know that milk ad where the guy walks into his corner store asks the lady for milk? She blandly spiels out the multiple varieties of different milk. Having asked a simple question, the guy gets confused now not knowing which one is right for him. He just wants...

Tell me why your firm is shifting away from asset-based fees?

It was a simple question and I knew I didn’t do it justice when it was asked. In fact, I didn’t realise it’s significant until afterwards. I blurted out a quick response which didn’t properly answer it. I’ve thought about it since. In fact, I’ve thought a lot about...